Depending on where you live, property taxes can be a small inconvenience or a major burden. The average American household spends $2,690 on property taxes for their homes each year, according to the U.S. Census Bureau, and residents of the 26 states with vehicle property taxes shell out another $444. Considering these figures and the massive amount of debt in America, it should come as no surprise that more than $14 billion in property taxes go unpaid each year, according to the National Tax Lien Association.

And though property taxes might appear to be a non-issue for the 35% of renter households, that couldn’t be further from the truth. We all pay property taxes, whether directly or indirectly, as they impact the rent we pay as well as the finances of state and local governments.

But which states have the largest property tax load, and what should residents keep in mind when it comes to meeting and minimizing their tax obligations? In search of answers, we analyzed the 50 states and the District of Columbia in terms of real-estate and vehicle property taxes. We also asked a panel of property-tax experts for practical and political insight.

Real-Estate Tax Ranking

| State | Rank |

|---|---|

| Hawaii | 1 |

| Alabama | 2 |

| Colorado | 3 |

| Nevada | 4 |

| Louisiana | 5 |

| South Carolina | 5 |

| District of Columbia | 7 |

| Delaware | 8 |

| Utah | 8 |

| West Virginia | 10 |

| Wyoming | 11 |

| Arkansas | 12 |

| Arizona | 12 |

| Idaho | 14 |

| Tennessee | 15 |

| California | 16 |

| Mississippi | 17 |

| New Mexico | 18 |

| North Carolina | 18 |

| Virginia | 20 |

| Montana | 21 |

| Indiana | 21 |

| Kentucky | 23 |

| Florida | 24 |

| Oklahoma | 25 |

| Georgia | 25 |

| Oregon | 27 |

| Washington | 28 |

| Missouri | 29 |

| North Dakota | 30 |

| Maryland | 31 |

| Minnesota | 32 |

| Massachusetts | 33 |

| Alaska | 34 |

| South Dakota | 35 |

| Maine | 36 |

| Kansas | 37 |

| Michigan | 38 |

| Ohio | 39 |

| Pennsylvania | 39 |

| Rhode Island | 39 |

| Iowa | 42 |

| Nebraska | 43 |

| New York | 44 |

| Wisconsin | 44 |

| Texas | 46 |

| Vermont | 47 |

| New Hampshire | 48 |

| Connecticut | 49 |

| Illinois | 50 |

| New Jersey | 51 |

Real-Estate Property Tax Rates by State

|

Rank |

State |

Effective Real-Estate Tax Rate |

Annual Taxes on $244.9K Home* |

State Median Home Value |

Annual Taxes on Home Priced at State Median Value |

|---|---|---|---|---|---|

| 1 | Hawaii | 0.29% | $700 | $662,100 | $1,893 |

| 2 | Alabama | 0.41% | $1,007 | $157,100 | $646 |

| 3 | Colorado | 0.51% | $1,243 | $397,500 | $2,017 |

| 4 | Nevada | 0.55% | $1,346 | $315,900 | $1,736 |

| 5 | Louisiana | 0.56% | $1,384 | $174,000 | $983 |

| 5 | South Carolina | 0.56% | $1,379 | $181,800 | $1,024 |

| 7 | District of Columbia | 0.57% | $1,402 | $635,900 | $3,641 |

| 8 | Delaware | 0.58% | $1,426 | $269,700 | $1,570 |

| 8 | Utah | 0.58% | $1,418 | $339,700 | $1,967 |

| 10 | West Virginia | 0.59% | $1,437 | $128,800 | $756 |

| 11 | Wyoming | 0.61% | $1,484 | $237,900 | $1,442 |

| 12 | Arkansas | 0.62% | $1,513 | $142,100 | $878 |

| 12 | Arizona | 0.62% | $1,520 | $265,600 | $1,648 |

| 14 | Idaho | 0.63% | $1,546 | $266,500 | $1,682 |

| 15 | Tennessee | 0.66% | $1,606 | $193,700 | $1,270 |

| 16 | California | 0.75% | $1,828 | $573,200 | $4,279 |

| 17 | Mississippi | 0.79% | $1,937 | $133,000 | $1,052 |

| 18 | New Mexico | 0.80% | $1,948 | $184,800 | $1,470 |

| 18 | North Carolina | 0.80% | $1,963 | $197,500 | $1,583 |

| 20 | Virginia | 0.82% | $2,006 | $295,500 | $2,420 |

| 21 | Montana | 0.83% | $2,033 | $263,700 | $2,189 |

| 21 | Indiana | 0.83% | $2,021 | $158,500 | $1,308 |

| 23 | Kentucky | 0.85% | $2,084 | $155,100 | $1,320 |

| 24 | Florida | 0.86% | $2,110 | $248,700 | $2,143 |

| 25 | Oklahoma | 0.90% | $2,194 | $150,800 | $1,351 |

| 25 | Georgia | 0.90% | $2,192 | $206,700 | $1,850 |

| 27 | Oregon | 0.93% | $2,266 | $362,200 | $3,352 |

| 28 | Washington | 0.94% | $2,311 | $397,600 | $3,752 |

| 29 | Missouri | 0.98% | $2,389 | $171,800 | $1,676 |

| 30 | North Dakota | 1.00% | $2,441 | $209,900 | $2,092 |

| 31 | Maryland | 1.07% | $2,628 | $338,500 | $3,633 |

| 32 | Minnesota | 1.11% | $2,708 | $250,200 | $2,767 |

| 33 | Massachusetts | 1.20% | $2,936 | $424,700 | $5,091 |

| 34 | Alaska | 1.22% | $3,000 | $282,800 | $3,464 |

| 35 | South Dakota | 1.24% | $3,040 | $187,800 | $2,331 |

| 36 | Maine | 1.28% | $3,143 | $212,100 | $2,722 |

| 37 | Kansas | 1.43% | $3,500 | $164,800 | $2,355 |

| 38 | Michigan | 1.48% | $3,630 | $172,100 | $2,551 |

| 39 | Ohio | 1.53% | $3,748 | $159,900 | $2,447 |

| 39 | Pennsylvania | 1.53% | $3,751 | $197,300 | $3,022 |

| 39 | Rhode Island | 1.53% | $3,752 | $292,600 | $4,483 |

| 42 | Iowa | 1.57% | $3,843 | $160,700 | $2,522 |

| 43 | Nebraska | 1.67% | $4,102 | $174,100 | $2,916 |

| 44 | New York | 1.73% | $4,231 | $340,600 | $5,884 |

| 44 | Wisconsin | 1.73% | $4,243 | $200,400 | $3,472 |

| 46 | Texas | 1.74% | $4,255 | $202,600 | $3,520 |

| 47 | Vermont | 1.90% | $4,652 | $240,600 | $4,570 |

| 48 | New Hampshire | 2.09% | $5,120 | $288,700 | $6,036 |

| 49 | Connecticut | 2.15% | $5,256 | $286,700 | $6,153 |

| 50 | Illinois | 2.23% | $5,465 | $212,600 | $4,744 |

| 51 | New Jersey | 2.47% | $6,057 | $355,700 | $8,797 |

*$244,900 is the median home value in the U.S. as of 2021, the year of the most recent available data.

Changes to Real-Estate Tax Rates Over Time

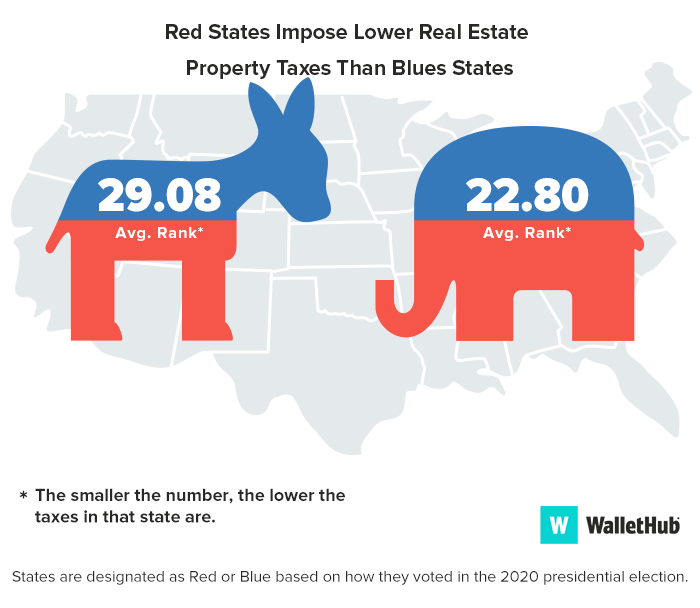

Red States vs Blue States

Vehicle Property Tax Ranking

| State | Rank |

|---|---|

| Hawaii | 1 |

| District of Columbia | 1 |

| Delaware | 1 |

| Utah | 1 |

| Idaho | 1 |

| Tennessee | 1 |

| New Mexico | 1 |

| Florida | 1 |

| Oklahoma | 1 |

| Georgia | 1 |

| Oregon | 1 |

| Washington | 1 |

| North Dakota | 1 |

| Maryland | 1 |

| Alaska | 1 |

| South Dakota | 1 |

| Ohio | 1 |

| Pennsylvania | 1 |

| Rhode Island | 1 |

| New York | 1 |

| Wisconsin | 1 |

| Texas | 1 |

| Vermont | 1 |

| Illinois | 1 |

| New Jersey | 1 |

| Louisiana | 26 |

| Michigan | 27 |

| California | 28 |

| Alabama | 29 |

| Iowa | 30 |

| Arkansas | 31 |

| North Carolina | 32 |

| Montana | 32 |

| Minnesota | 34 |

| Indiana | 35 |

| Kentucky | 36 |

| Nebraska | 37 |

| West Virginia | 38 |

| Arizona | 38 |

| Colorado | 40 |

| Wyoming | 41 |

| New Hampshire | 41 |

| Nevada | 43 |

| Kansas | 44 |

| Connecticut | 45 |

| Massachusetts | 46 |

| Maine | 47 |

| South Carolina | 48 |

| Missouri | 48 |

| Mississippi | 50 |

| Virginia | 51 |

Vehicle Property Tax Rates by State

|

Rank |

State |

Effective Vehicle Tax Rate |

Annual Taxes on $26K Car* |

|---|---|---|---|

| 1 | Hawaii | 0.00% | $0 |

| 1 | District of Columbia | 0.00% | $0 |

| 1 | Delaware | 0.00% | $0 |

| 1 | Utah | 0.00% | $0 |

| 1 | Idaho | 0.00% | $0 |

| 1 | Tennessee | 0.00% | $0 |

| 1 | New Mexico | 0.00% | $0 |

| 1 | Florida | 0.00% | $0 |

| 1 | Oklahoma | 0.00% | $0 |

| 1 | Georgia | 0.00% | $0 |

| 1 | Oregon | 0.00% | $0 |

| 1 | Washington | 0.00% | $0 |

| 1 | North Dakota | 0.00% | $0 |

| 1 | Maryland | 0.00% | $0 |

| 1 | Alaska | 0.00% | $0 |

| 1 | South Dakota | 0.00% | $0 |

| 1 | Ohio | 0.00% | $0 |

| 1 | Pennsylvania | 0.00% | $0 |

| 1 | Rhode Island | 0.00% | $0 |

| 1 | New York | 0.00% | $0 |

| 1 | Wisconsin | 0.00% | $0 |

| 1 | Texas | 0.00% | $0 |

| 1 | Vermont | 0.00% | $0 |

| 1 | Illinois | 0.00% | $0 |

| 1 | New Jersey | 0.00% | $0 |

| 26 | Louisiana | 0.10% | $26 |

| 27 | Michigan | 0.61% | $160 |

| 28 | California | 0.65% | $170 |

| 29 | Alabama | 0.69% | $181 |

| 30 | Iowa | 1.00% | $262 |

| 31 | Arkansas | 1.02% | $267 |

| 32 | North Carolina | 1.20% | $314 |

| 32 | Montana | 1.20% | $316 |

| 34 | Minnesota | 1.29% | $337 |

| 35 | Indiana | 1.33% | $350 |

| 36 | Kentucky | 1.45% | $379 |

| 37 | Nebraska | 1.46% | $384 |

| 38 | West Virginia | 1.68% | $440 |

| 38 | Arizona | 1.68% | $440 |

| 40 | Colorado | 1.79% | $468 |

| 41 | Wyoming | 1.80% | $472 |

| 41 | New Hampshire | 1.80% | $472 |

| 43 | Nevada | 1.86% | $487 |

| 44 | Kansas | 1.91% | $500 |

| 45 | Connecticut | 2.12% | $555 |

| 46 | Massachusetts | 2.25% | $590 |

| 47 | Maine | 2.40% | $629 |

| 48 | South Carolina | 2.63% | $690 |

| 48 | Missouri | 2.63% | $690 |

| 50 | Mississippi | 3.50% | $917 |

| 51 | Virginia | 3.96% | $1,039 |

*$26,220 is the value of a Toyota Camry LE four door Sedan (as of February 2023), the highest-selling car of 2022.

Ask the Experts

Property taxes are an extremely important issue since they impact all of our lives. But how should we incorporate them into our financial decision making? And how should policy makers across the U.S. approach them as well? For answers to those questions and more, we consulted a panel of tax and public-policy experts. You can check out their bios and responses to key questions below.

- Do people consider property taxes when deciding where to move? Should they?

- Should nonprofits pay property taxes?

- Should local tax policy be adjusted to rely more or less on property taxes versus other forms of taxation?

- Should more types of property be subject to property taxes? If yes, what types?

- Should certain groups of people be exempt from property taxes or be taxed at a lower rate?

Source: “2023’s Property Taxes by State“