Overview

Regulation and oversight of climate disclosure and related carbon measurement is coming to the U.S. On April 9, 2021, the United States Securities and Exchange Commission (SEC) issued a risk alert cautioning firms that their Environmental, Social, and Governance (ESG) statements will be more heavily scrutinized. Deborah Cloutier, CRE, outlines how evolving ESG strategies may impact commercial real estate globally.1 In the U.S., following the SEC risk statement, President Joe Biden issued an Executive Order requiring federal regulatory and mitigation plans for climate-related financial risk.2 These actions follow the March 10, 2021 implementation of required ESG reporting in the European Union on the Sustainable Finance Disclosure Regulation (SFDR).3, 4

The many real estate firms, states, and municipalities setting carbon neutrality targets to mitigate climate risks should prioritize processes and systems that can withstand regulatory scrutiny.5 Based on historical patterns, regulation requiring third-party verification of climate disclosures analogous to accounting audits is highly likely.

This article first provides brief background on the heavy regulatory push and industry demand for carbon neutrality disclosure in the United States. Following the background, author insights revolve around three key areas: First, what globally accepted carbon-neutral measurement, reporting, and strategic framework does your firm use? Second, are the carbon offsets you purchase in compliance with United Nations (UN) standards, from an accredited source, and/or SEC-verifiable? Third, what third-party auditing of your Global Greenhouse Gas (GHG) measurement is in place and are they by a certified auditor, such as an ISO 14000 Family (Environmental Management) auditor?6

Background

Regulatory Push

The Biden White House Executive Order on Climate-Related Financial Risk charged the government to establish a government-wide strategy regarding “the measurement, assessment, mitigation, and disclosure of climate-related financial risk,” by Fall 2021.7 This specifically mentioned Employee Retirement Income Security Act of 1974 (ERISA) and new requirements for major federal suppliers (e.g. Real Estate providers) to disclose greenhouse gas emissions and climate-related financial risks.

The Executive Order builds on a recent series of regulatory actions. The aforementioned SEC risk alert cautioned, “variability and imprecision of industry ESG definitions and terms can create confusion among investors.”8 The Wall Street Journal interpreted this to mean that “some investment firms…were potentially misleading investors.”9 The National Law Review stated that “Courts may find that unsupportable statements on environmental initiatives are not mere puffery, but actionable under anti-fraud laws.”

Carbon Neutral Demand Leads Regulation

The regulatory push, in part, responds to significant market demand for certifiable and transparent carbon disclosure methods. Drivers of demand come from municipalities, pension funds, and investment funds. Numerous U.S. cities have pledged to become carbon neutral as part of the Carbon Neutral Alliance. The Bloomberg Climate Alliance recently funded 25 cities pledging to reduce carbon output and/or become carbon neutral. Specific to pension funds, the Climate Action 100+ has 49 U.S.-based “Asset Owners” committed to carbon neutrality at a fund level. Similarly, in the investment world, the Net Zero Asset Managers Initiative contains 87 asset managers with $37 trillion in assets pledged to achieve net-zero carbon.

In short, a large and growing segment of influential stakeholders in the real estate capital markets have already established themselves on a path to carbon neutrality. This begs the question of how, given increased regulatory oversight, they will achieve this goal in a transparent and defensible way.

Media Shows Increased Focus

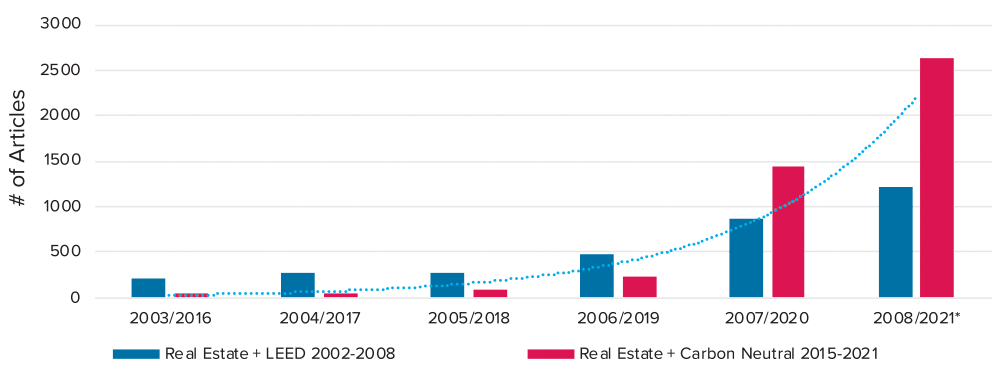

Media attention towards carbon neutrality and real estate continues to escalate geometrically. The graph in Figure 1, generated from a LexisNexis search of articles, emphasizes this point, showing the prevalence of the combined keywords “Carbon Neutral and Real Estate” in recent years compared to media attention towards Leadership in Energy Efficient Design (LEED) in the early 2000s when it gained significant popularity.

Figure 1: Media Attention Towards Carbon Neutrality and LEED

In response, ratings firms have already enacted new ESG measures, such as Institutional Shareholder Services (ISS) launching new ESG performance and risk scorecards. Moody’s recently produced climate-adjusted credit scores for approximately 37,000 public companies.10 S&P Global added 400 data points to ESG scores.11 Urban Land Institute, in conjunction with Heitman, recently published a report entitled “Climate Risks a Determinate Factor for Real Estate Investors.”12

In summary, the awareness of climate risk among institutional investors is not new. An increased and broader focus from the wider market and media participants is.

Insight 1: Standards

Globally Accepted Carbon Neutral Measurement Systems

The SEC alert stated, without expressly endorsing any strategy, that firms should adhere to a voluntary ESG global standard such as the Equator Principles or the U.N.-sponsored Principles for Responsible Investment (UNPRI) and Sustainable Development Goals (SDGs) as examples.13, 14 An in-depth discussion of these and related ESG programs requires its own article; the purpose here is to provide a high-level understanding of what leading systems are that may meet the SEC guidance.

Simplifying, two major levels could be assessed for carbon measurement. First, what processes, systems, baselines, and quality control mechanisms are in place to ensure consistent and accurate measurements. Second, what specific global greenhouse gas (GHG) measurement system is used at the asset level.

The SEC mentioned systems, the Equator Principles and the UNPRI, fall in the first category. They frequently refer to the Paris Accord and the Task Force on Climate-Related Financial Disclosures (TCFD).15, 16 These documents outline those organizational-level processes and strategies, representing great systems for firms to act upon.

Strategies focusing on compliance should consider measurement standards accepted by the United Nations Framework Convention on Climate Change (UNFCCC). Most major systems, including those discussed above, defer to the Greenhouse Gas (GHG) Protocol for asset-level (and some further organizational) GHG reporting metrics.17 The GHG Protocol, the PAS 2050/2060 certification strategy developed by the British Standards Institution, and ISO 14064 are all UNFCCC approved.

As the SEC specifically avoided endorsing any strategy, the exact acceptable future standards remain opaque. However, those listed above are clearly global standards with wide acceptance that appear aligned with current regulatory guidance. UNFCCC approved strategies typically cross continental boundaries and are highly likely to be included in ultimate regulation.

ISO 14000 Family as a Global Standard, a Brief Overview

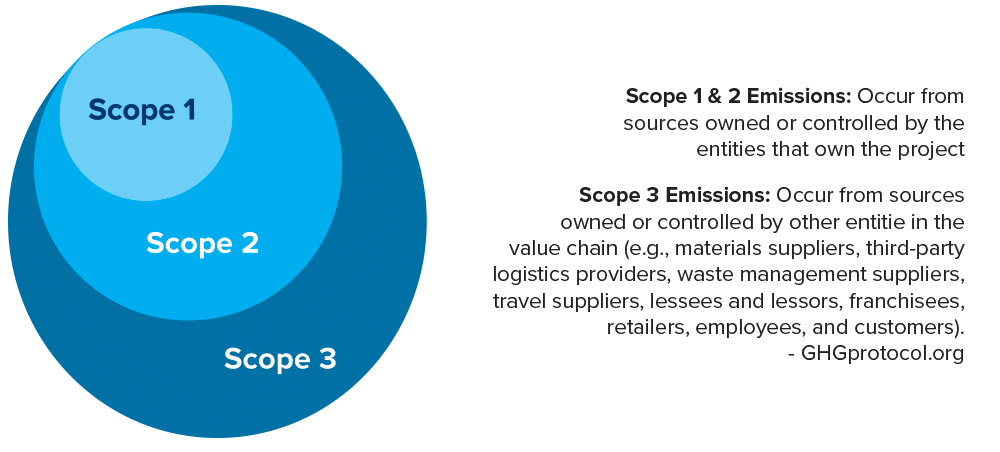

ISO 14064 and 14065 address greenhouse gas accounting and verification. Audit boundaries define the scope of a project and its ultimate third party review. When properly measured and offset with ISO, a firm meets the definition of Carbon Neutrality. Measuring and offsetting Scope 1, 2 & 3 emissions meets the definition of Net Zero Emissions. The decision to focus on Scope 1, 2 &/or 3 encompasses environmental and strategic components and should be discussed both internally and potentially with an outside expert.

The graphic in Figure 2 gives a high-level view.

Figure 2: Scope 1, 2, and 3 Emissions

Source: Net Zero Analysis 2021

ISO 14001 International Environmental Management Audit allows for flexible boundary setting on company or project audits. These boundaries are an important part of reporting transparency, as they clearly define the scope of the audit, making it directly comparable to other similar project audits. Examples of audit boundaries for new construction:

- Carbon Neutral Construction (Scope 1 & 2): An acceptable plan should address the entire Carbon Footprint and Environmental Impacts from architectural design and owner decisions, including environmental impacts of the construction of the building. While each project is unique, a “typical” project might include site energy and construction while excluding land-use changes.

- Net Zero Construction (Scope 1, 2 & 3): An acceptable plan would include everything within the project’s Carbon Neutral Construction Audit Boundaries plus the value-chain carbon footprint. This would include the business activities of all the contractors, designers, supply houses, and job-site employees. As shown in the Figure 1 diagram, the entire supply chain would have to be carbon neutral.

Related, and the potential subject of its own article, ISO 14024 and 14025 are the metrics for measuring “Product GHGs through a Life Cycle Assessment” (LCA). This is the basis for an Environmental Product Declaration (EPD) via the International EPD* System.18 In North America the Carbon Leadership Form (CLF) has developed the Embodied Carbon in Construction Calculator, or “EC3 Modeling Tool,” which is used in determining the GHG emissions for all materials used in construction and maintenance of a real estate asset, delivering a total Embodied Carbon Footprint.19

Obviously, this brief overview provides only a surface understanding of the ISO 14000 family processes which include: Setting Audit Boundaries, Data Collection, Measurement, Reduction Plans, Compensation (carbon offsetting), Third-Party Review, and Reporting. An ISO professional can help with your specific needs which may include the use of additional measurement strategies, building management systems and/or an internet of things (IOT) installation.

LEED and GRESB?

Leadership in Energy and Environmental Design (LEED) provides many benefits to building owners and tenants and, for many firms, acts as a key ESG input.20, 21 However, LEED buildings are not carbon neutral under any UNFCCC/Paris Accord criteria. Therefore, though LEED (BREAMM, Green Globes, etc.) may be a valid and important part of your ESG platform, specific to carbon neutrality, none of those certifications count. Also, while the United States Green Building Council (USGBC) does offer a separate LEED program towards carbon neutrality, their standards are not aligned the GHG Protocol, UNFCCC or ISO 14000 family standards as of this writing.

Similarly, GRESB provides potential ESG benefits across a variety of dimensions.22 Many capital sources consider strong GRESB ratings as signals of ESG excellence. However, to the best of our knowledge, specific to carbon disclosure, their standards are not aligned with the GHG Protocol, UNFCCC or ISO 14000 family as of this writing.

Strategies for Carbon Mitigation

Most carbon reduction frameworks call for organizations to prioritize direct on-site emission reductions. This begins with baseline assessment in accordance with a globally approved protocol like ISO 14000 family of standard, PAS 2050/2060 or the Corporate GHG Protocol.23 After assessing baseline, the reduction of carbon output would always be the primary path prior to assessing the potential impact of purchasing renewable energy certificate (RECs) and/or carbon offsets. Specific carbon and energy mitigation strategies depend on a myriad of organizational and asset level considerations, best assessed with experts in those areas.

As of UN Climate Change Conference COP 25 conference, RECs apply in different ways depending on whether they are in the same State or Province as the user. if the Renewable Energy Facility and the offtaker are not in the same State or Province Boundary the offtaker can only claim “Supporting Renewable Energy.” If the Renewable Energy Facility and the offtaker are in the same State, Province, microgrid, or e-grid Boundary than the offtaker can claim they are using Renewable Energy and apply the Fuel Switching Clean Development Mechanism (CDM) and claim the reduction in carbon footprint. Typically, the use of RECs permit the user to lower their Scope 2 emissions, although, in some scenarios, with the validation of an outside expert, RECs may create a carbon offset project.

After carbon mitigation strategies and, potentially, RECs have been effectively implemented, remaining carbo output can be offset.

Insight 2: Carbon Offsets

What is an Offset?

For those not familiar with carbon offsets, they are a security representing a formally measured reduction in GHG emissions or an increase in carbon storage (e.g., through land restoration or the planting of trees) – that is used to compensate for emissions that occur elsewhere. Effectively, the purchase of an offset funds and/or supports projects that reduce GHG emissions.

The United Nations certifies carbon offsets through the UNFCCC; they developed a group of methodologies under the Clean Development Mechanism (CDM) for large and small projects, which are periodically updated.24 UNFCCC Carbon Offset Registry lists projects that meet the current CDM Rules and Reference and where their Certified Emission Reductions (CER) carbon offsets can be found.25, 26

A registry is a central clearinghouse where offsets are validated, issued, and retired. The UNFCCC has only recognized a handful of carbon offset registries as assuring valid carbon offsets. More information can be found at the UN Carbon Offset Platform.27 Additional Carbon Offset Registries that meet the UNFCCC standards are VERRA and Gold Standard.28, 29 These registries list carbon offsets from CDM Projects and develop new methodologies that follow the UNFCCC CDM Rules and Reference requirements.

Compliance Markets vs. Voluntary Markets

Currently, two carbon offset markets exist: the Compliance Markets for regulated entities offsetting as required by statute, law or regulation, and the Voluntary Carbon Market for non-regulated business entities and individual carbon offset purchases.

Remember, carbon offsets are securities and thus fall under SEC and/or FINRA regulation and registration requirements.30 To be exempt from registration, the transactions must meet specific criteria. Very few do, which means that trading in unregistered securities is rampant in the voluntary carbon offset marketplace. Compliance and Voluntary Markets are both, in fact, regulated markets at the following levels:

- At the carbon offset project level by the UNFCCC CDM as the international standard

- At the national level in the U.S. by the SEC for securitized offsets, and Commodity Futures Trading Commission (CFTC) for carbon offsets as a commodity

- At the regional level, U.S. examples include the Western Climate Initiative (WCI) and Regional Greenhouse Gas Initiative (RGGI); these are Compliance Cap-and-Trade Markets31, 32

- At the sub-regional level, one U.S. example is the New York City Law 97.33 This is a Cap-and-Trade Market within the larger RGGI Market.

Due to the historical lack of verification and documentation, the Voluntary Carbon Market as a whole should be labeled “caveat emptor.” A number of carbon offset sellers in this space represent their offsets as meeting all of the “Global Standards,” but fail to use licensed Broker-Dealers and may not meet the requirements for a registration exemption. Additionally, many carbon offsets in the Voluntary Carbon Market do not meet the labeling requirements for the Federal Trade Commission – 16 CFR part 260 and Green Guides 2020.

Due to the historical lack of verification and documentation, the Voluntary Carbon Market as a whole should be labeled “caveat emptor.” A number of carbon offset sellers in this space represent their offsets as meeting all of the “Global Standards,” but fail to use licensed Broker-Dealers and may not meet the requirements for a registration exemption. Additionally, many carbon offsets in the Voluntary Carbon Market do not meet the labeling requirements for the Federal Trade Commission – 16 CFR part 260 and Green Guides 2020.34, 35

Most of the Voluntary Carbon Offset Transactions are private placements, which are never recorded. One example of this is The Nature Conservancy’s Fake Forest Offsets which used a non-UNFCCC carbon offset registry.36 This allowed the use of a noncompliant methodology, which they marketed to companies naïve regarding necessary due diligence and the inherent risks involved in purchasing the offsets. While most ESG professionals bring tremendous experience, the complicated set of rules and regulations regarding carbon footprint frequently extend beyond their education and budget constraints. Organizations should be sure to ask carbon offset sellers for:

- Record of compliance with UN strategies and markets

- Evidence of their broker-dealer relationship and/or registered exception to sell

- Chain-of-custody documentation for retirement

SEC-Regulated Carbon Offset Markets

Although more may enter, at the time of this writing, the Entrex Carbon Market is the only U.S. SEC-regulated carbon offset market.37 Entrex trades in compliance, voluntary, and regulated-market specific carbon offsets.38

The advantage to using an SEC-regulated market is the offloading of regulatory compliance risk. Firms purchasing offsets from an SEC-regulated and approved exchange should easily be able defend the validity of those offsets to an SEC regulator in the future.

The transactional paperwork from the Entrex Carbon Market provides full transparency to support corporate ESG reporting and disclosure claims. All quality assurance, quality control, CDM methodology review, and audits for all projects seeking to place carbon offsets on the Entrex Carbon Market must be performed by an ISO 14000 Family Lead auditor.

Insight 3: External Verification

Third-Party Audit

Virtually every system suggests external third-party verification at the asset level. For example, the GHG Protocol says, “for external stakeholders, external third-party verification is likely to significantly increase the credibility of the GHG inventory.” PAS recommends either ISO 14001 or Greenhouse Gas Protocol for external third-party verification. See Figure 3.

Figure 3: Measuring Emissions

Source: UNFCCC39

An ISO 14000 Family auditor currently meets international standards and aligns with current regulatory guidance. At the UNFCCC Congress of the Parties (COP) 25 in 2019 “International Standards Are Key to Carbon Transition,” Miguel Naranjo, Programme Officer at UN Climate Change, said, “ISO standards and internationally agreed rules and guidelines play a crucial role in ensuring such credibility.”40 PAS 2050 recommends ISO 14001 (part of the ISO 14000 Family) for external verification. The ISO 14000 family is accepted by the UNFCCC, the UNPRI, and the sole current SEC-regulated carbon offset exchange for external verification.

UNFCCC

The UNFCCC REPORTS Commitments to Net Zero, through the UN Race to Zero campaign, have doubled in less than a year including approximately 733 cities, 31 regions, 3,067 businesses, 173 institutional investors, and 622 Higher Education Institutions reporting voluntary carbon disclosures.41, 42 In 2021, the committee has seen 100% increase in growth of requests from firms preparing for more regulated disclosures. UNFCCC Climate Neutral Now has seen 500 Companies reporting their Carbon Footprint, Reduction Plans, and Carbon Offset usage in 2021.

Adhering to UNPRI or Equator Principles require measuring, managing for sustainable outcomes, and reporting—typically to the UNFCCC Climate Neutral Now (CNN) Initiative. That team uses ISO 14000 for definitions and terms and the ISO 14001 International Environmental Management Audit for data handling, which covers setting audit boundaries, data collection, measurement, reduction, contribution (to an offset project), third-party review, and publishing the report on the company or project website.

While it is possible other accreditations may ultimately be included in SEC guidance, the ISO 14000 Family is a currently accepted global standards that should withstand any regulatory scrutiny and is highly likely to be included in ultimate regulation.

Conclusion

Climate disclosure regulations are law in the European Union. Every signal from the Biden administration, regulatory bodies and related entities suggests formal regulations will happen in the near term in the U.S. Many multi-national firms already are struggling to understand and meet the guidelines of EU regulatory requirements and these will be only confounded by new U.S. regulations. Firms that raise capital across multiple regions also are subject to the current EU and future U.S. rules.

This article outlined, at a high level, strategies that meet current United Nations standards. One consistent signal appears from the continued opacity firms face in meeting EU SFDR and future U.S. standards, that global standards in accordance with the Paris Accord and United Nations directives appear acceptable.

This article provided insights around three key questions. First, what are globally accepted carbon-neutral measurement systems? These include frameworks such as the GHG Protocol, PAS 2050/2060, or ISO 14064. Second, are your carbon offsets compliant? Firms should understand that traded carbon offsets are securities that are already regulated by FINRA/SEC/CFTC and they should confirm their purchases are approved by or formally exempt from those bodies. Further firms should ensure offsets are compliant with UNFCCC standards, approved by a third party, and prepared to withstand scrutiny. Finally, what third-party verification should my firm use? Third-party auditing needs to be performed by qualified personnel under acceptable standards—at this time, the ISO 14000 family meets all relevant global standards.

Source: “The Coming U.S. Regulatory Oversight of, and Demand for, Climate Disclosure“