Big investors continue to find higher return on investment in student housing than multifamily or office properties. For example, Singapore’s sovereign wealth fund recorded $16.2 billion of student housing purchases in 2016 and an additional $3.3 billion of transactions in Q1 2017, according to Real Capital Analytics.

“Student housing is a whole different world than residences for families or seniors,” says Will Baker, senior vice president and managing director at Walker & Dunlop in Birmingham, Ala. “We look at each college campus individually and evaluate the trends, such as enrollment growth, competition for student housing on- and off-campus, and which students are required to live on campus.”

However, he expects a decrease in supply after 2017, based on more restrictive construction financing terms. While Baker doesn’t believe student housing is recession-proof, he calls it “recession resistant.”

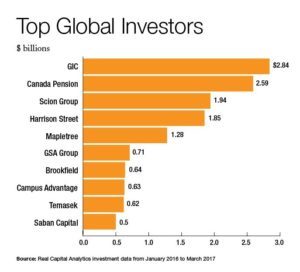

Attracted by student housing’s stability, other top global investors in student housing include GIC, Canada Pension, Scion Group, and Campus Advantage. Nationally, higher numbers of international students flowing into U.S. colleges continue to fuel optimism. Students from China and India top the list, according to Oxford Economics.

Sunbelt Rising

Nationally, most new units are springing up off-campus, in mixed-use development high rises with retail on the ground level. The most desirable locations are close enough for students to walk to campus or commute quickly by light rail.

Boosts in student enrollment drive student housing, with the heaviest activity in the Sunbelt states, according to Scott Streiff, executive vice president at JLL Capital Markets in St. Paul, Minn. “During the last 20 years, the Sunbelt states have built triple the number of new student housing units compared to the rest of the U.S.,” says Streiff, who specializes in multifamily and student housing.

Streiff points to data from AxioMetrics that show about 450,000 student housing units have been constructed in the south and southeastern U.S. during the past two decades. Securing second place, the Midwest boasts 150,000 new student housing units.

While most construction has been in high-amenity student housing during the past five years, the next level of growth will be for more moderately priced student housing, according to Sonny Ginsberg, co-founder of Ginsberg Jacobs LLC in Chicago. “There’s room for growth in next 20 percent of student housing,” he says. “The saturation level differs in this space for students with more limited housing budgets.”

The cycle for high-amenity student housing has been hot for several years. Signaling a slight slowdown, underwriting for loans is getting tighter, and new construction requires more equity now than a few years ago, says Ginsberg, who represents lenders in student housing and also conducts retail leasing for CA Ventures.

Small Investors Beware

While cities like Boston and Chicago are home to multiple universities, secondary and tertiary markets serve as hubs for most campuses and experience higher demand for student housing.

“College towns have become tech centers and have turned into year-round communities in smaller markets, especially in the Midwest,” Ginsberg says.

While student housing holds continued luster for investors, it is not easy money, according to Jim Tansey, CCIM, managing broker of Lockard Commercial in Coralville, Iowa. Currently, Tansey brokers transactions and develops retail opportunities for the University of Iowa campus in Iowa City, Iowa. Previously, he was an owner of student housing properties.

“We work to educate small investors about student housing, which is not a quick-profit investment,” he says. “Cap rates are below market, and undergraduate students are not good caretakers of properties.”

Likening student housing to an arms race, he says as an owner it’s tough to keep up with needed renovations and desirable new amenities. As an alternative, Tansey finds the student-specific retail market is a good niche for investment.

While Iowa City is a tertiary market, Tansey is working with more big players because “lots of opportunities in the primary and secondary markets are picked over.”

On the upside for investment, “student housing does well when the economy is strong and is stable in down cycles,” Tansey says.

Building Reputation

Establishing and maintaining a good reputation at universities is a top priority. Those colleges attract high-quality students, drawing from greater numbers of applicants.

“Due to the substantial capital investment required to develop and establish real estate investments, it is risky for an investor to be the first to move into areas where a particular university has not established its gravitational pull for attracting other viable commercial endeavors,” says Mario Guevara, CCIM, real estate project manager at Silver City Partners Ltd. in Winter Park, Fla.

The management of student housing investments requires providing capital management, overseeing the property, and keeping up with the local economic pulse. “Due to constantly evolving tastes, student housing assets have to comply and conform to market trends, which usually means large capital infusions,” he says.

In Guevara’s market, the University of Central Florida hit its stride in the 1990s and has been strengthening its undergraduate and graduate programs ever since. Through its 54 years of operations, increasing numbers of its graduates have found good jobs locally.

For instance, UCF provides many engineers to nearby Cape Canaveral. Specialized positions in the military, Walt Disney World, and other entertainment businesses are other good employers for UCF graduates.

Describing the Orlando metro area as “bursting at the seams,” Guevara sees UCF spurring multiple offshoots, which create opportunities for other businesses to flourish. In turn, this propels demand for more commercial property development.

Midwest Hub

College towns like Columbus, Ohio, often have more than one major university to support the expansion of student housing, as well as other commercial property development. Yet even with 20 universities and colleges in the Columbus metro area, The Ohio State University stands out for its consistently robust enrollment growth – between 5 and 10 percent annually. During the past five years, higher numbers of students have fueled nearly $2 billion in construction.

Of that budget, 25 percent was invested in renovations and newly built on-campus dorms to support Ohio State’s mandate in 2016 for sophomores to live in on-campus university housing. Previously, only freshmen had to live on-campus.

Despite the loss of sophomores to on-campus housing, Steve Reynolds, CCIM, predicts 10,000 more residential units will be added to the core urban center of Columbus. “I don’t see any reason for student housing to slow down here,” says Reynolds, owner of Pinnacle Associates in Grandview Heights, Ohio. “If the economy tanks, Ohio State enrollment will not decrease from 66,000 students to 33,000.”

As an investor in student housing, he advises buyers “to buy right, sell right, and know what you’re buying into, such as student housing built close to campus.”

Retail Gems

In the past decade, some large universities show significant shifts in students living on campus versus commuting students. For example, the University of Minnesota in Minneapolis traditionally had 80 percent commuter students, and now it has a 50/50 split between commuters and on-site dwellers.

As a result, student housing has expanded by 5,000 units in the last five years. Along with additional housing has come the need for more retail, which is targeted for students’ tastes and budgets.

On the retail side of student housing, Barry Brottlund, CCIM, has seen mixed-use projects change the commercial property dynamic near the University of Minnesota’s campus.“The merchandise mix for students has to be determined carefully,” says Brottlund, principal at InSite Commercial Real Estate in Vadnais Heights, Minn.

For example, near the University of Minnesota campus, Target has plenty of bedding, potato chips, nuts, and beef jerky, with a smorgasbord of sandwiches and highly caffeinated drinks. Students gravitate toward local ethnic restaurants, mobile phone service providers, fitness centers, and coffee shops like Starbucks, according to Brottlund.

With their busy schedules, students want retail shopping close by – saving them time, money, and resources, he says. “What doesn’t sell well are soft goods, especially fashionable clothing,” Brottlund says.

While student housing continues its solid performance for multiple investors, caution is creeping into some local markets for U.S. universities. Investors have to evaluate each market individually and look closely at trends for each college.

By: Sara S. Ptterson (CCIM)

Click here to view source article.