Introduction

For the first time ever, some of the most respected and prominent real estate industry associations came together to support a return to occupancy and beyond survey designed to help their members and the broader industry succeed in re-occupancy and future strategic planning.

Shared and standardized data is powerful for informing real estate professionals to be effective, especially during a pandemic. Building data as well as people data. Data is needed to understand current trends and to forecast future trends. In response, the leading real estate associations aligned to launch a survey of building professionals in North America. The findings of this survey help to better understand a shifting relationship between workers needs and the workspaces needed; with data to inform current and future real estate strategies.

Findings

Key themes from the research emerged around re-occupancy preparedness, employee-centric services, and hybrid workplaces. Participants agree that the majority of workplaces are prepared for re-entry and equipped for a healthier re-occupancy (e.g., HVAC air filtration) with more wellness strategies, employee amenities and concierge services. With the challenges of access to reliable, high-speed internet serving employees working from home (WFH) it is arguable which alternative is more productive, supporting a case for flexibility. Some of the key findings are:

Preparedness

1. There is a high level of preparedness when bringing people back to office.

a. 86% of survey participants have already returned to working in the office, at least part-time.

b. Most survey participants responded that their buildings have been, or are being, equipped with improved HVAC air filtration systems. 94% of building managers surveyed have implemented or are considering upgraded HVAC filters. This includes MERV-13 or higher rated filters that have been installed or are likely to be for over three-quarters of the buildings; ionization has been implemented or is likely to be in over half the buildings. This is followed by increased security (including additional signage, automated biometric and temperature scanners) and desk and meeting room reservation systems.

c. Two-thirds of buildings will have hand-sanitation stations and frequent cleaning of high-touch areas in most areas.

d. Safety, health and well-being of employees is most important to top management in devising a return to office strategy.

e. 61% of facility managers say temperature tests will be required to enter the office.

f. 68% have created some form of Return to Occupancy (RTO) Task Force, and half of these task forces will be led by facilities/property management (FM/PM).

Figure 1: Which of the following is or will be leading the Return to Occupancy Task Force?

Source: Return to Occupancy & Beyond, 2021 Survey, chart created by HarrisX

2. 61% of property managers have or are planning to add health and wellness services and 44% are planning to add concierge and reception services.

Planning for the Future

3. Decision-makers are assembling teams across their companies and documenting return-to-occupancy plans, contingency plans and budgeting for more technology and wellness services.

a. Managers are preparing for potential COVID surge. 60% already have a documented contingency plan and 30% are preparing one.

b. Besides the Facilities Management and health/safety representation, RTO task forces include representation for key FM technical areas (HVAC, space management, security), Human Resources and Information Technology with Sustainability and Finance having significantly less representation.

c. 90% of the respondents are confident in their plan’s ability to succeed.

d. Management rates ‘safety, health and well-being of all building occupants’ as the highest importance with ‘return of the building to pre-pandemic occupancy’ as the lowest importance. Other areas highlighted include:

i. Use of technology for smooth workflow

ii. Costs to protect the building and its occupants

iii. Timeliness to make the necessary improvements to open the building

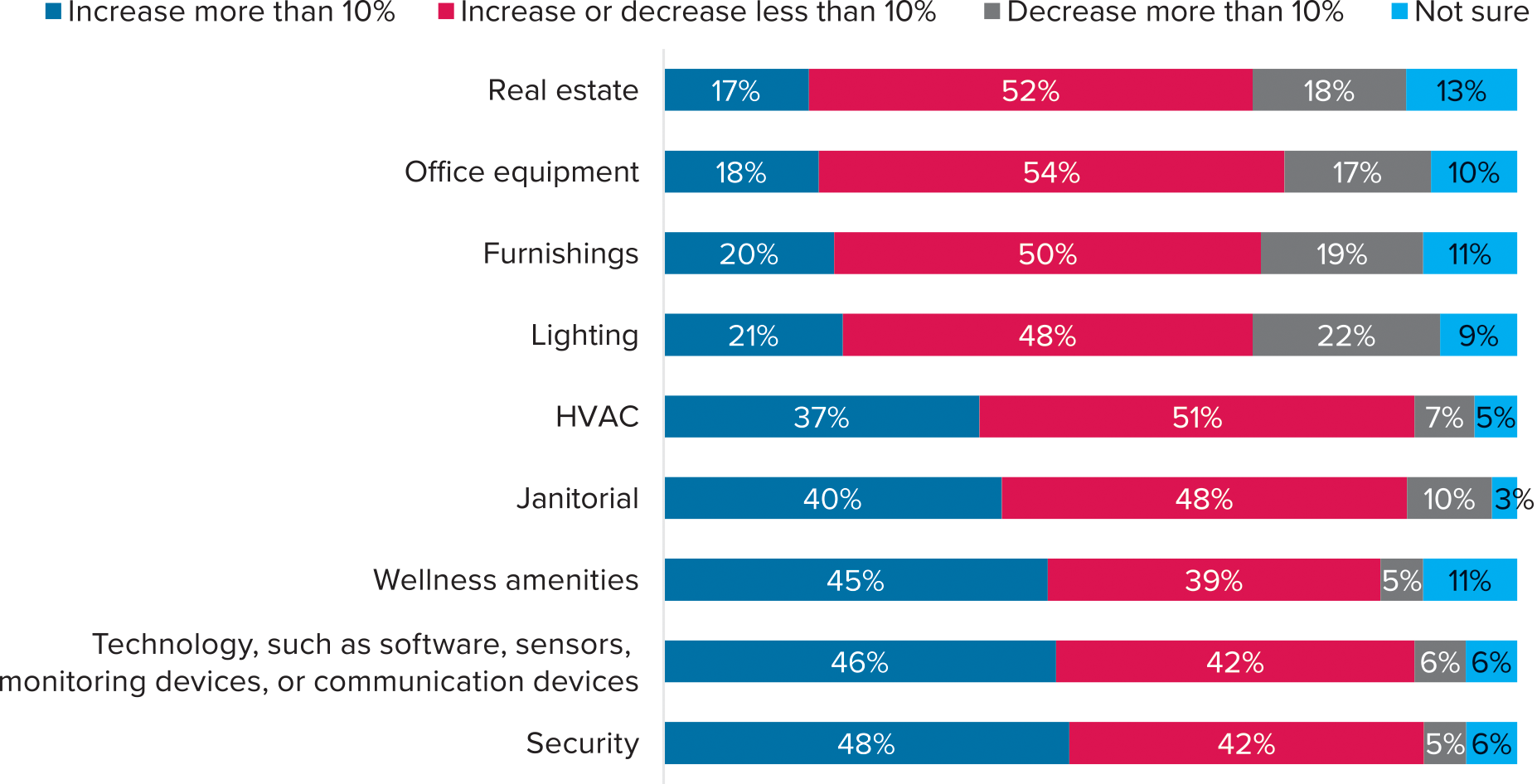

e. Half of the companies are planning to increase the budget by more than 10% for security systems, technology devices and wellness amenities.

Figure 2: Which of the following budget areas are expecting an annual budget increase or decrease of at least 10%?

Source: Return to Occupancy & Beyond, 2021 Survey, chart created by HarrisX

Insourcing & Outsourcing

4. Half of managers think facilities operating and administrative staffing levels will be the same as pre-pandemic; a third think it will be somewhat higher.

5. Half of security and over one-third of janitorial (42%), operations (37%), and maintenance (38%) outsourcing has increased since the pandemic started.

a. These increased levels of outsourcing were highest when people managed 20 or more buildings.

b. The increased levels of outsourcing were highest for newer buildings.

Employee Centric Services & The Hybrid Workplace Office

6. For employees with children at home, strategies such as flexible work benefits and data standards are being explored to facilitate the safe transition back to the office.

a. 67% of facility professionals agree data will play a greater role in office management once people return to the office.

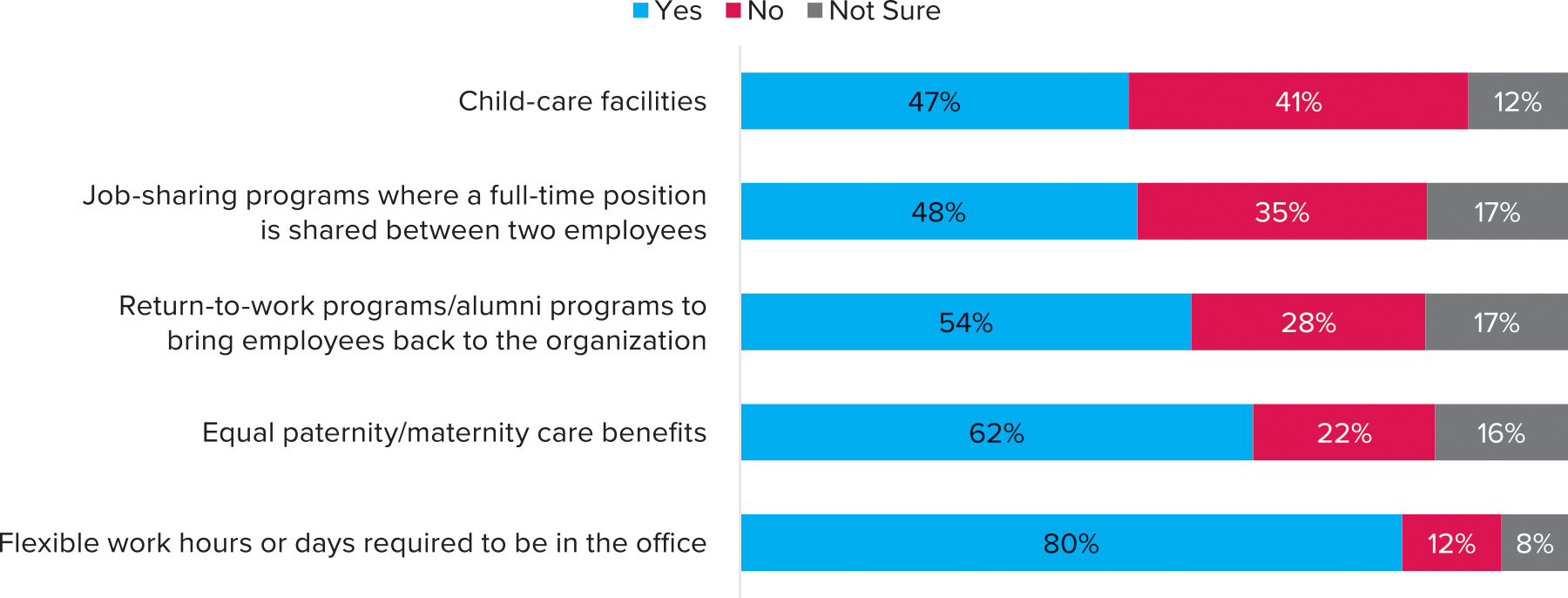

b. Managers plan to extend parental benefits after the return to the office, with 80% pledging to provide flexible work hours.

Figure 3: Indicate below the benefits that are or will be provided to employees who have children at home.

Source: Return to Occupancy & Beyond, 2021 Survey, chart created by HarrisX

7. Over half of building managers foresee workers returning to the office at least 3 days a week and they are preparing the office space for a hybrid workforce.

a. Most likely scenarios are for a hybrid return-to-work for 3-5 days per week (55% of respondents), with an additional 23% saying their workers will have a 50-50 work location strategy. Only 21% of the respondents said most staff will work remotely for the majority of their work hours.

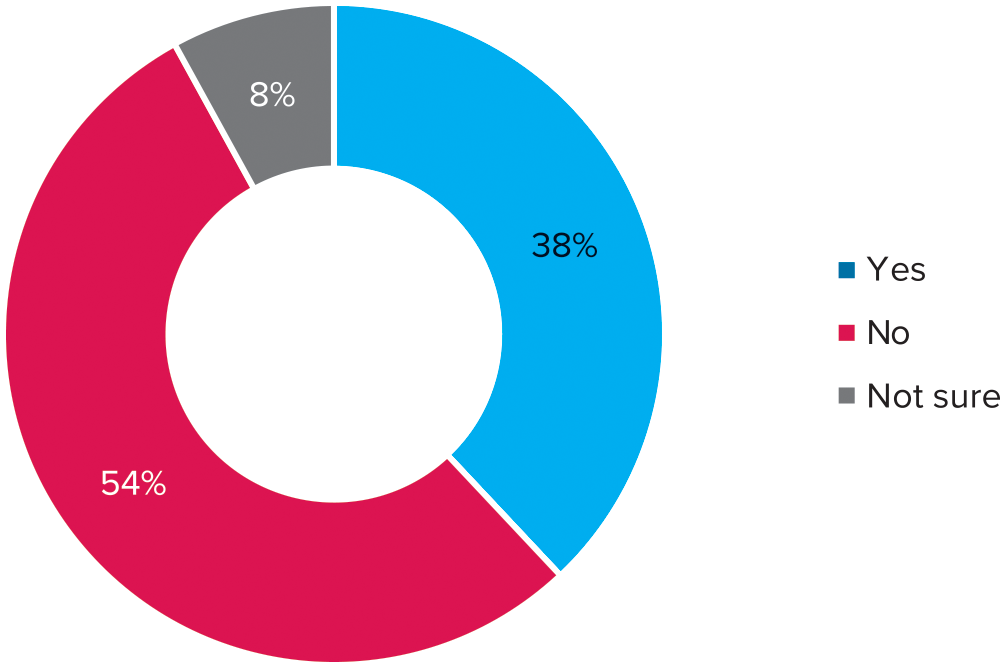

8. Just over half (54%) of office building managers say their organization is not planning to change their building space.

a. Of those who plan to relinquish space, 45% project they will relinquish 11%-25%, with an additional 32% expect to have a reduction of 10% or less.

b. There was not a strong pattern in terms of where space would be relinquished. 25% of the space would be relinquished in the CBD, but the same amount would be relinquished in less-expensive suburban locations, and 19% in the urban areas, which are in-between the CBD and suburban sites in terms of both location and cost.

Figure 4: Is your organization or the client you serve planning to expand, relinquish space, or relocate people from one building to another?

Source: Return to Occupancy & Beyond, 2021 Survey, chart created by HarrisX

9. Remote work opportunities will be an important way to retain talent going forward. As such, – employees will need access to high-speed internet to enable a more effective, hybrid work.

a. 4 in 10 managers estimate that at least half of their employees lack high-speed internet that would better facilitate working from home.

b. Spaces that accommodate virtual workers are the most likely to increase (75%) alongside conference rooms and outdoor meeting spaces. Large conference rooms accommodating 10 or more persons and private offices are decreasing

c. There will be a greater focus on data ethics, data standards and data governance, according to two-thirds of the respondents.

d. 7 in 10 office managers are planning to provide software and office equipment to support working from home while the number drops below half for office furniture, plants, gym memberships and subsidies for other home expenses.

e. Remote work benefits could become a differentiator to retain talent.

f. To retain talent, most organizations plan to allow employees to choose how many days they work remotely. Nearly half will provide well-being amenities, allow employees to work from anywhere (even another city or state), pay for relocation expenses (for key talent) and pay additional compensation for most employees.

Figure 5: How is the organization planning to retain talent?

Source: Return to Occupancy & Beyond, 2021 Survey, chart created by HarrisX

About the Survey

Blue Skyre IBE invited certain real estate industry associations to come together to support this groundbreaking industry-leading survey. These associations’ memberships are made up of market influencers who manage and advise on buildings and commercial real estate. The associations that participated in supporting and distributing the survey to their members for input were:

- Counselors of Real Estate (CRE)

- Institute of Real Estate Management (IREM)

- International Facility Management Association (IFMA)

- International Well Building Institute (IWBI)

Survey participants were located in the US and Canada and included facility professionals, investment property professionals, real estate consultants and credentialed Counselors of Real Estate®, who have professional insights and/or front-line responsibility for planning and executing the return to office occupancy strategy and aligning it with the internal and external dynamics that are impacting the strategy. “Internal” means within their control and “external”: means the impact of factors outside of the stakeholders’ control in the building’s vicinity and have a significant impact on their return to occupancy plans and policies.

The survey considered organization & building types, internal and external factors as seen in Figure 6.

Figure 6: Organization types, building types, and internal and external factors

| Organization & Building Type | Internal | External |

| Portfolio size, building size, building type, and industry type | Management direction and guidelines (safety, social distancing, work-from-home) | Percentage of schools open |

| Owned, leased, multi-tenant, single-tenant | Financial and staffing | Day care availability |

| Building Class: A, B, C | Real estate and relocation | Public transportation |

| Job Description | Occupancy and space utilization | Vaccine availability |

| HVAC | Politics | |

| Technology | ||

| Resiliency |

The associations sponsoring the “Return to Occupancy & Beyond Survey” recognized this unique effort to capture deep, broad data not found in other surveys to reveal the true status of occupiers’ and owners’ plans for safely returning staff to the office. The survey collected granular information on the measures taken to prepare the people, physical buildings and systems for occupancy. The results from this survey provide insights to areas such as: worker connectedness, worker and employer priorities, confidence in the preparedness efforts for the return to the office, identification of decision-makers, changes in occupancy, operational adjustments, worker accommodations and the financial hit of these changes. The data enables the ability to learn more about what is happening currently in the industry.

The benefit of the data collected will help guide decision-makers to determine the state of their preparedness, provide a more accurate measure of when companies think staff will return to the office, the expected mixture of work from home and office and operating practices intended to carry-out these plans. What enabled these insights is how the survey was designed to address questions around:

- How the use of space is being re-evaluated by occupiers and real estate owners

- How well prepared they are for the evolving space size, configuration, and location shifts

- How worker expectations are driving these shifts

- How transformation is being enabled by technology

What also differentiates this survey is that it was administered by HarrisX, an independent, internationally recognized market research and consulting services company. Cory Brown, its Head of Custom Research, stated that it has “seen nothing like this being done.” Many of the surveys conducted to-date collect data based upon a binary response that does not sufficiently reveal the true status of the surveyed organizations’ plans and their strategies for moving ahead. For example, a response may indicate that staff has returned to work, but the binary nature of the survey questions does not reveal that only the critical staff has returned while a definitive return date for the rest of the staff has not been determined, or that the result ties into whether the company provides daycare or not. Also, a respondent may indicate that a return to the office plan is in place but there is no indication on the completeness of the plan, thereby indicating an incomplete level of preparedness.

Peter Kimmel of Peter Kimmel & Associates, who served in an advisory capacity on the project, stated, “By asking in-depth questions and then sorting the results by the type of organization and building, we were able to understand better why some trends applied in some cases but not all. For example, there was a general trend toward more janitorial and security outsourcing, especially in newer buildings and for those who managed twenty or more buildings. We also identified trends within certain buildings, such as increases in the number of small conference rooms while decreasing the number of large ones. We not only learned in depth what organizations were doing within their buildings to return to occupancy, but also how they planned to address and support those working from home. These survey results can be applied by others to make their staffs’ return to work safer and more productive, whether they work from the office or their homes.”

The Return to Occupancy online survey was conducted within the United States and Canada from June 28, 2021 – August 12, 2021, among 458 facility professionals responded. According to HarrisX, the sampling margin of error of this poll is plus or minus 4.58 percentage points.

Conclusions

The survey results indicate a substantial shift in the way businesses and their employee talent will be returning to the office. Employee health, wellness and well-being are the leading priorities of property/facility managers, employers and workers. As such flexibility and agility entails remote work and work from home programs and policies, changes in workspace design and use, and changes in property operating protocols and amenities.

The cost of renting will likely be impacted as a result of these fundamental shifts in the demand for space use, new building operating protocols and new building amenities and services to attract and retain tenants.

Facility management and workplace management are also changing to meet the demands of new protocols being put in place by companies, and to meet the changing needs and expectations of their staff talent. The costs for operating properties, facilities and workplaces will be different going forward and therefore will begin to establish new operating cost expense benchmarks which will differ from the cost benchmarks which existed prior to the pandemic. Employers will also be challenged to try to find and implement more reliable internet solutions for their employees working from home and remotely.

The learnings from the survey will aid decision-makers with incorporating resiliency into the operating plans for their business, their occupied spaces, and buildings. It will also begin to inform planning for new types of operating expense budgeting for properties, facilities, workplaces and talent working offsite. The findings support a high level of preparedness when bringing people back into the office, contingency plans for future events, increases in employee-centric services and support for the hybrid office and hybrid work accommodations.